The Importance of Building a Unified Culture in Mergers and Acquisitions

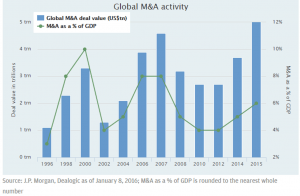

According to a recent report, M&A activity is expected to increase and gain momentum in 2016, especially in the energy and mining industries, for some strategic and advantageous consolidations.

M&A activity can signal a great opportunity for companies. However, they have to be managed effectively. According to a Forbes article, more than half of M&A transactions fail, “the sad fact is that most deals look great on paper, but few organizations pay proper attention to the integration process.”

The true value of a successful M&A transaction can only be captured when culture clash is avoided and cultures are actively managed as a critical component of the integration.

Here are four keys to successful culture integrations:

- Be proactive. Make understanding culture gaps a key component of the due diligence phase.

- Develop a culture integration plan and communicate it often and early in the process.

- Create an aspirational future state culture so both teams are on board with the plan.

- Make culture a key component of the leadership’s integration objectives and set measurable and short interval goals.

Most M&A deals fail to meet pre-acquisition objectives. More often than not culture clash is a key factor. Plan, measure, control and execute effectively to be best in class.

This blog was written by Michael O’Connell, Executive Vice President at Trindent Consulting. He has over 12 years of global and domestic consulting experience working with leading organizations to identify and implement profit improvement strategies

English

English